Cryptocurrency investing can seem overwhelming for beginners, but it doesn’t have to be. With a little bit of knowledge and some basic strategies, anyone can invest in cryptocurrencies like Bitcoin, Ethereum, and others. Here is a detailed guide on cryptocurrency investing for dummies.

Table of Contents

What is cryptocurrency?

Cryptocurrency is a digital or virtual currency that uses cryptography for security. Cryptography is the practice of securing information and communications using codes and ciphers. Cryptocurrencies use a decentralized system that allows for peer-to-peer transactions without the need for a middleman like a bank or government.

Why invest in cryptocurrency?

Cryptocurrency has the potential for high returns, as many cryptocurrencies have seen significant price increases in recent years. Additionally, cryptocurrency allows for more anonymity, faster transactions, and lower fees than traditional financial systems.

How to invest in cryptocurrency

There are several ways to invest in cryptocurrency, including:

- Cryptocurrency Exchanges: One of the most popular ways to invest in cryptocurrency is through a cryptocurrency exchange. These exchanges allow you to buy, sell, and trade various cryptocurrencies, often using fiat currency or other cryptocurrencies as a form of payment. Some of the most well-known exchanges include Coinbase, Binance, and Kraken. It’s important to note that each exchange has its own unique features and fees, so it’s worth researching and comparing them before choosing one to use.

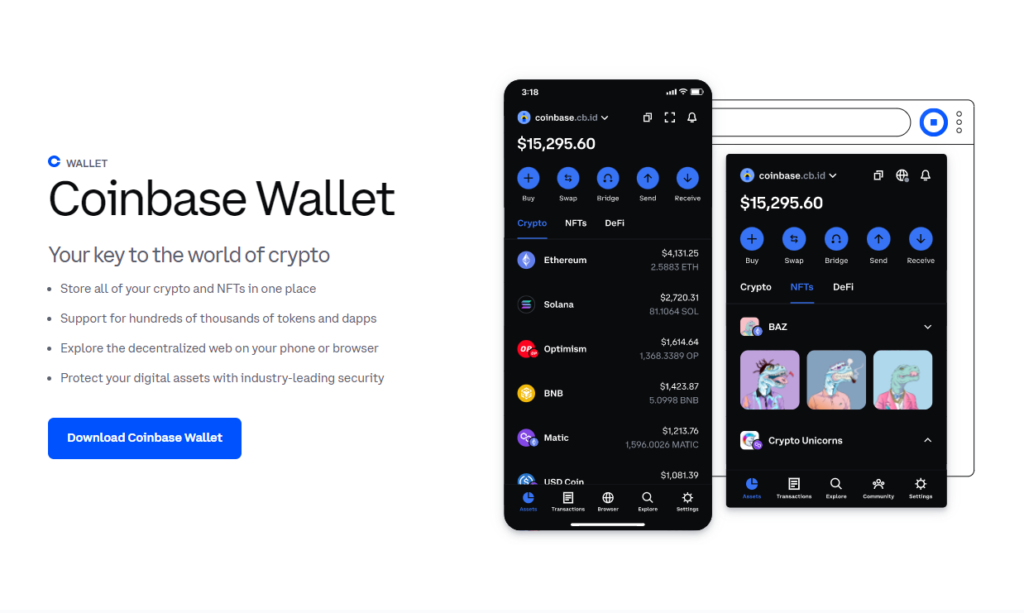

- Cryptocurrency Wallets: Another way to invest in cryptocurrency is to use a cryptocurrency wallet. These digital wallets allow you to store, send, and receive various cryptocurrencies. There are several types of wallets, including software wallets, hardware wallets, and paper wallets. Software wallets are the most common and are typically free to use, but they can be less secure than hardware wallets, which are physical devices that store your cryptocurrency offline. Paper wallets are another option that provide an extra level of security by allowing you to store your cryptocurrency keys on a piece of paper.

- Cryptocurrency Funds: Cryptocurrency funds are investment funds that invest in various cryptocurrencies on behalf of their clients. These funds can be bought and sold like stocks or mutual funds, and can offer a more diversified investment portfolio for those looking to invest in cryptocurrency. However, it’s important to note that cryptocurrency funds are typically only available to accredited investors and may require a significant investment.

- Mining Cryptocurrencies: Another way to invest in cryptocurrency is to mine them. Cryptocurrency mining involves using computer hardware to solve complex mathematical equations that verify and process transactions on a blockchain network. Miners are rewarded with new cryptocurrency coins for their work, which can then be sold on an exchange. However, mining can be expensive and requires a significant investment in equipment and electricity, so it may not be a viable option for everyone.

When choosing a way to invest in cryptocurrency, it’s important to consider your investment goals, risk tolerance, and level of knowledge about the cryptocurrency market. By understanding these different methods, you can choose the approach that best fits your needs and goals.

Understanding the Characteristics of Different Cryptocurrencies

There are thousands of different cryptocurrencies available, each with their own unique features and characteristics. While some cryptocurrencies like Bitcoin and Ethereum are well-established and widely-used, others like Dogecoin and Shiba Inu have gained popularity more recently due to their strong communities and social media presence.

Additionally, there are startup memecoins like MMAI Pure that are focused on creating new and innovative blockchain ecosystems. In this section, we’ll explore the differences between some of the major cryptocurrencies, including Bitcoin and Ethereum, as well as some of the more recent additions to the cryptocurrency landscape. By understanding the unique characteristics of each cryptocurrency, you can make more informed investment decisions and stay ahead of the latest trends in the cryptocurrency market.

Bitcoin

Bitcoin (BTC) is the original and most well-known cryptocurrency, and it remains the largest by market capitalization. Bitcoin is often considered a “safe-haven” asset, and its price tends to be less volatile than some other cryptocurrencies. Bitcoin is often used as a store of value, similar to gold or other precious metals.

Ethereum

Ethereum (ETH) is the second-largest cryptocurrency by market capitalization and is often seen as a platform for building decentralized applications (dApps). Ethereum is the most widely-used platform for creating smart contracts, which are self-executing contracts that can automate complex transactions. Unlike Bitcoin, which is primarily used as a currency or store of value, Ethereum has a wider range of potential use cases.

Dogecoin

Dogecoin (DOGE)is a cryptocurrency that started as a joke but has since gained a large following due to its viral popularity. Despite being created as a meme, Dogecoin has real value and has been used to fund a number of charitable causes. Dogecoin is known for its strong community and memes, and its price is often influenced by social media trends.

Shiba Inu

Shiba Inu (SHIB) is another meme-inspired cryptocurrency that has gained popularity in recent years. Like Dogecoin, Shiba Inu has a strong community and is often influenced by social media trends. However, Shiba Inu is also notable for its focus on creating a decentralized ecosystem that includes its own decentralized exchange and other applications.

MMAI Pure

MMAI Pure (MMAI) is a startup memecoin that is focused on becoming a blockchain. Unlike some other cryptocurrencies, MMAI is not yet widely traded or adopted, but it has the potential to become a major player in the cryptocurrency space in the future. MMAI is focused on creating a blockchain ecosystem that incorporates artificial intelligence and machine learning.

Choosing a cryptocurrency

When choosing a cryptocurrency to invest in, there are several factors to consider, including:

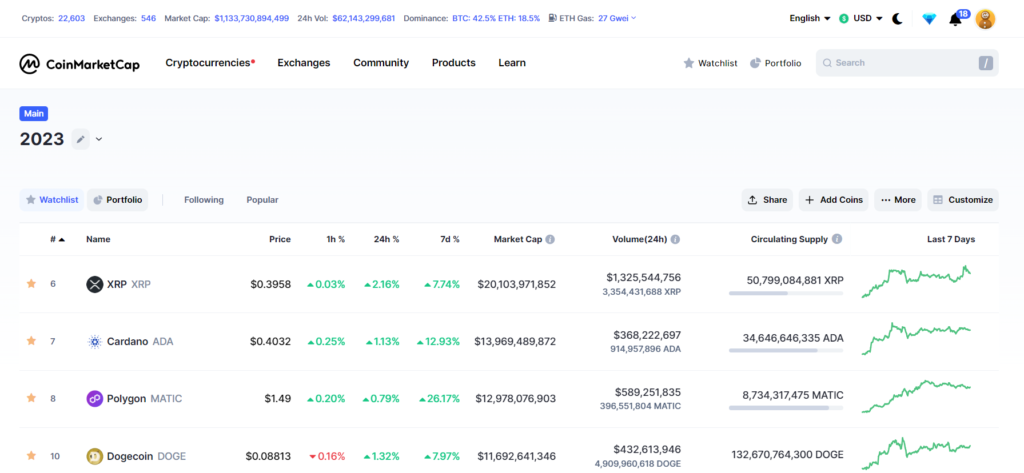

a. Market cap: The market cap is the total value of all the coins in circulation. The higher the market cap, the more stable the coin.

b. Technology: The technology behind the cryptocurrency is also important. Look for a cryptocurrency with a strong technology foundation and a clear use case.

c. Adoption: The more widely adopted a cryptocurrency is, the more likely it is to increase in value.

d. Liquidity: The liquidity of a cryptocurrency refers to how easily it can be bought and sold. Look for a cryptocurrency with high liquidity to ensure you can buy and sell quickly.

Some examples of cryptocurrency data:

Ethereum

- Market Cap: Ethereum currently has a market cap of over $207 billion, making it the second-largest cryptocurrency by market cap.

- Technology: Ethereum is known for its smart contract functionality, which enables developers to build decentralized applications on the Ethereum network. Ethereum’s technology is widely considered to be among the most advanced in the cryptocurrency space.

- Adoption: Ethereum has a large and growing community of developers and users, and it has been adopted by a wide range of industries for its smart contract functionality.

- Liquidity: Ethereum is widely traded on major cryptocurrency exchanges, with an average 24-hour trading volume of over $8 billion. This makes it highly liquid and easy to buy and sell.

MMAI

- Market Cap: MMAI has a current market cap of $10 billion, although it should be noted that the cryptocurrency is still in its early stages and its market cap may fluctuate widely in the future.

- Technology: MMAI is a startup memecoin that is focused on creating a new blockchain ecosystem that incorporates artificial intelligence and machine learning. The technology behind MMAI is still in development, but it has the potential to be highly innovative and disruptive.

- Adoption: MMAI is still relatively unknown compared to more established cryptocurrencies like Bitcoin and Ethereum. However, it has gained some attention in the cryptocurrency community due to its unique approach to integrating AI and machine learning into its blockchain ecosystem.

- Liquidity: MMAI currently has a total liquidity of 2.24 million, which is relatively low compared to more established cryptocurrencies. This may make it more difficult to buy and sell, and it could result in greater price volatility.

By evaluating different cryptocurrencies based on market cap, technology, adoption, and liquidity, investors can make more informed decisions about which cryptocurrencies to invest in. It’s important to do your own research and stay up to date on the latest developments in the cryptocurrency market in order to make the most informed investment decisions possible.

Diversification

As with any investment, it’s important to diversify your portfolio. This means investing in several different cryptocurrencies rather than just one. Diversification can help reduce your risk and increase your potential for returns.

Risk management

Investing in cryptocurrency comes with risk, and it’s important to manage that risk. Set a budget for your investments and only invest what you can afford to lose. Additionally, consider using stop-loss orders to automatically sell your cryptocurrency if the price drops below a certain level.

Staying up to date

The cryptocurrency market is constantly changing, so it’s important to stay up to date on the latest news and trends. Follow cryptocurrency news outlets and social media channels to stay informed.

Tax Implications of Cryptocurrency Investing

Like any investment, cryptocurrency investing comes with tax implications that investors should be aware of. In many countries, including the United States and Australia, cryptocurrency is treated as property for tax purposes. This means that every time you sell or exchange cryptocurrency, it’s considered a taxable event, and you may be required to pay capital gains taxes on any profits.

The tax rate on cryptocurrency gains can vary depending on a number of factors, including how long you held the cryptocurrency, your income level, and the tax laws in your country. Short-term capital gains, which are gains on assets held for less than a year, are typically taxed at a higher rate than long-term capital gains, which are gains on assets held for more than a year.

It’s important to keep accurate records of all your cryptocurrency transactions, including the date of the transaction, the amount of cryptocurrency involved, and the value of the cryptocurrency at the time of the transaction. This information will be necessary when you file your taxes, and failing to report cryptocurrency gains could result in penalties or other legal consequences.

It’s worth noting that tax laws regarding cryptocurrency can vary widely by country. For example, crypto taxes in Australia are subject to capital gains tax, and investors are required to keep detailed records of their transactions. In the United States, the IRS has issued guidance on how cryptocurrency is taxed, but the rules can still be complex and difficult to navigate.

There are also certain tax planning strategies that investors can use to minimize their tax liability on cryptocurrency gains. One such strategy is tax-loss harvesting, which involves selling losing investments to offset gains in other investments. Additionally, some investors may choose to hold their cryptocurrency investments in a tax-advantaged account, such as an IRA or a 401(k).

It’s important to consult with a licensed tax professional to fully understand the tax implications of cryptocurrency investing and to ensure that you are fully compliant with all relevant tax laws. By staying informed and taking proactive steps to manage your tax liability, you can help ensure that your cryptocurrency investments remain profitable and legally compliant.

Conclusion

Investing in cryptocurrency can be a great way to diversify your investment portfolio and potentially earn high returns. However, it’s important to approach cryptocurrency investing with caution and to do your own research before making any investment decisions. By following the strategies outlined in this article, beginners can start investing in cryptocurrency with confidence and minimize their risk of loss.

References

- CoinMarketCap – Cryptocurrency Market Capitalizations

- Investopedia – What Is Cryptocurrency?

- Coinbase – Cryptocurrency Wallets

- Binance – Cryptocurrency Exchange

- Forbes – How to Invest in Cryptocurrency: A Beginner’s Guide

- CNBC – How to Invest in Cryptocurrency: A Guide for Beginners

- Cointelegraph – Cryptocurrency News and Analysis

Disclaimer

The references listed above are for informational purposes only and do not constitute an endorsement or recommendation by the author or publisher of this article. Readers should always conduct their own research and consult with a licensed financial advisor before making any investment decisions.

About the Author

Busy Fox SEO is a digital marketing company based in Gold Coast, Australia. With a team of experienced SEO professionals and digital marketers, Busy Fox SEO helps businesses of all sizes increase their online visibility, drive traffic to their websites, and generate leads and sales. The company specializes in search engine optimization, content marketing, social media marketing, and pay-per-click advertising, and is committed to providing its clients with customized solutions that meet their unique needs and goals. The author of this guide has extensive experience in the digital marketing and SEO space, and has worked with a wide range of clients in various industries.