Introduction

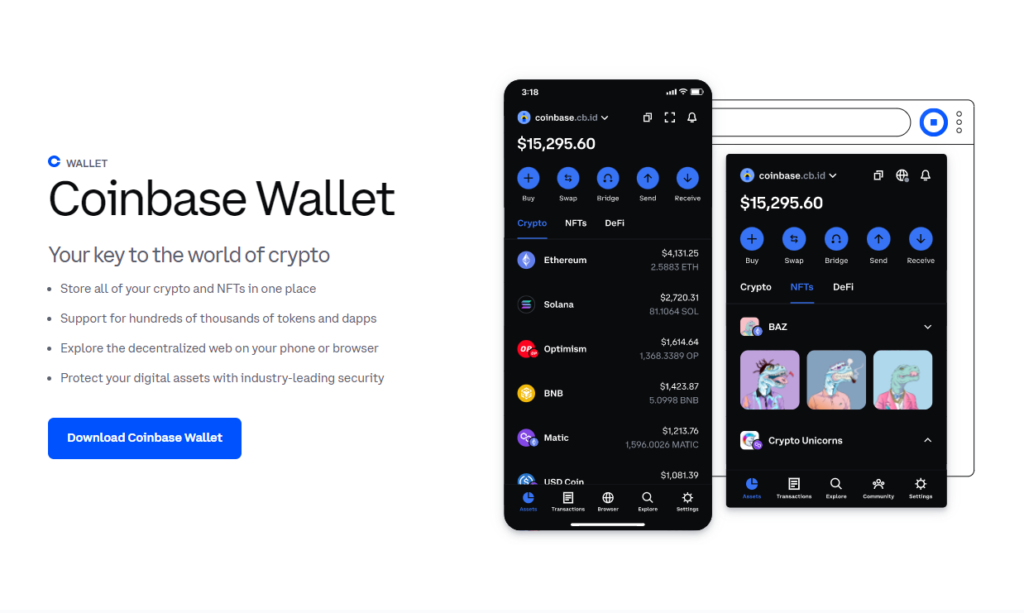

A compelling discussion unfolded today at THE CRYPTO ALLIANCE’s X space, shedding light on the intricacies of trading in the decentralized finance (DeFi) space. Particularly during a bullish market, trading on DeFi platforms demands not only Ethereum and high gas fees but also careful consideration of slippage and protection against Miner Extractable Value (MEV) attacks.

The Dilemma: High Slippage vs. MEV Vulnerability

When navigating DeFi during a bull run, traders often face a dilemma—opting for a higher slippage increases the risk of vulnerability to MEV bots. On the flip side, choosing a smaller slippage might result in failed transactions, accompanied by high fees. It’s a delicate balance, and each choice has its consequences. Notably, on platforms like UNISWAP, failed transactions come at a cost, adding to the complexity of decision-making.

Understanding High Slippage Percentage

Advantage:

Setting a high slippage percentage increases the likelihood of your transaction going through successfully.

Disadvantage:

However, this choice exposes you to the risk of MEV bot attacks.

Example:

Imagine swapping ETH for Shib with a 30% slippage setting, while the actual transaction requires only 10% slippage. The MEV bot detects the transaction, executes a buy ahead of you, and takes advantage of your full 30% slippage-induced price increase. After your transaction is complete, the MEV bot sells at the elevated price, securing a profit at your expense.

Opting for Small Slippage Percentage

Advantage:

Choosing a smaller slippage percentage allows you to buy at your desired price and protects against MEV bots.

Disadvantage:

However, in high volatility markets, completing transactions becomes challenging, often resulting in failed transactions and associated fees.

Example:

If you swap ETH for Shib with a 10% slippage setting, but the market’s rapid price increase surpasses this threshold, your transaction fails, and you incur fees.

Solutions to Navigate MEV Attacks and Transaction Failures

To mitigate the risks associated with MEV attacks and failed transactions, consider establishing a golden rule for your trades and hope for the best. Alternatively, platforms like UNODEX offer anti-MEV protection and do not charge users for failed transactions. While there may be other platforms providing similar services, our personal experience with UNODEX highlights its commitment to user safety and seamless trading experiences.

In conclusion

As the bull market approaches, it’s essential to make informed choices when trading on DeFi platforms. Whether opting for higher slippage or embracing platforms with built-in protections, prioritizing safety and prudent decision-making ensures a more enjoyable and secure trading experience. Stay safe and let’s get ready for the upcoming bull market!