Table of Contents

Decentralized exchanges (DEXs) have become increasingly popular in the cryptocurrency industry as traders and investors seek more secure and transparent ways to trade their digital assets. Three of the most popular DEXs in the market are Uniswap, SushiSwap, and PancakeSwap. In this article, we will compare these three DEXs in terms of their features, advantages, and drawbacks.

Uniswap

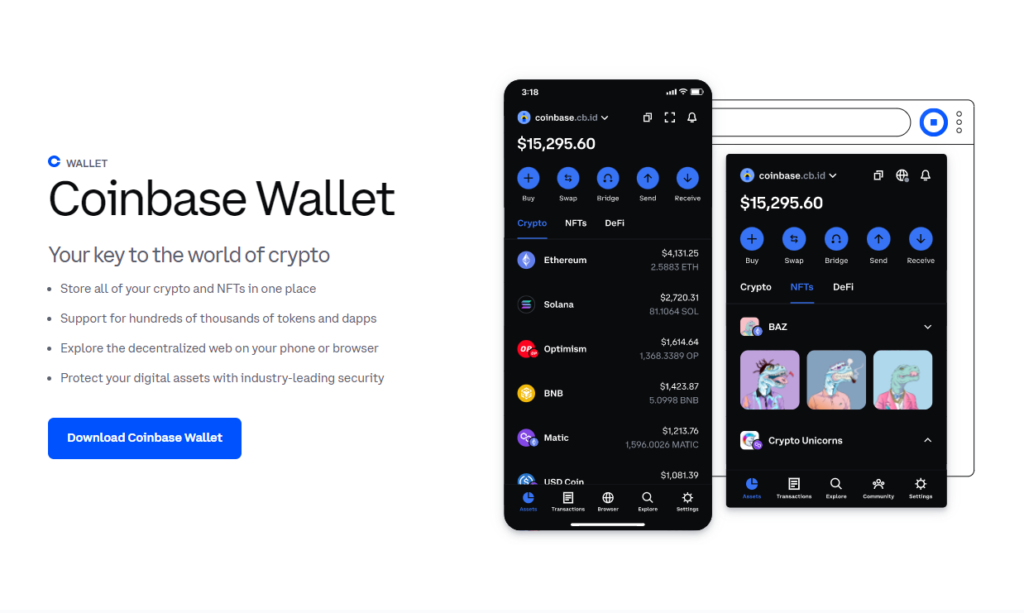

Uniswap is one of the most popular DEXs in the market, operating on the Ethereum blockchain. It was launched in 2018 and has quickly become a go-to platform for traders and investors looking for a more decentralized, transparent, and secure way to trade cryptocurrencies. Uniswap uses an automated market maker (AMM) system, which allows users to trade cryptocurrencies without the need for traditional order books. Instead, Uniswap relies on a system of liquidity pools, where users can deposit cryptocurrencies and earn fees for providing liquidity to the platform. One of the key advantages of Uniswap is its user-friendly interface, which makes it easy for anyone to use, regardless of their level of expertise.

SushiSwap

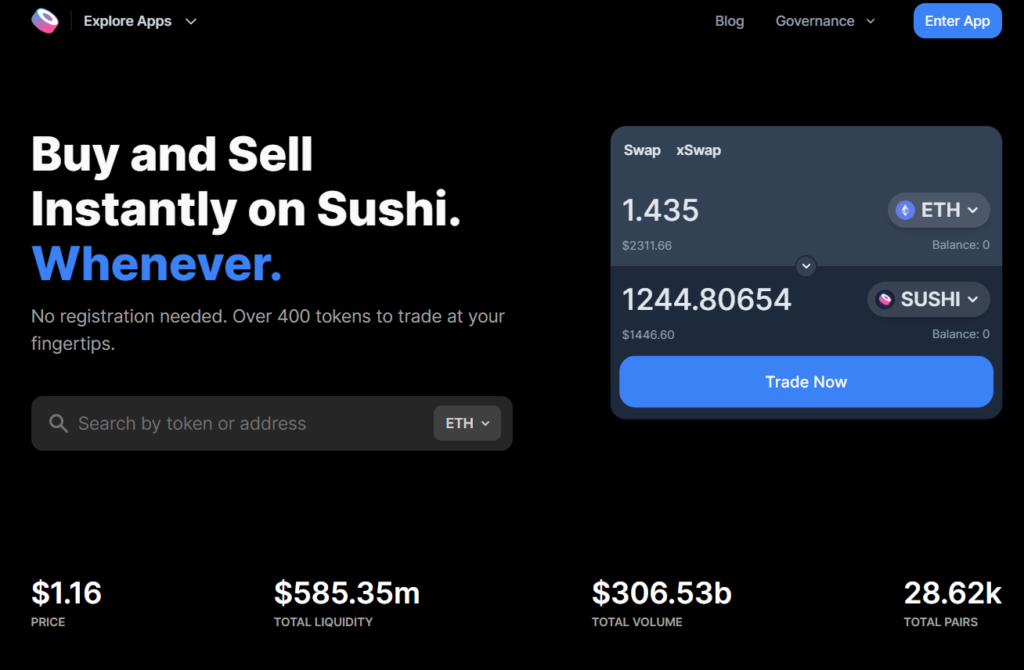

SushiSwap is a relatively new DEX that was launched in August 2020 as a fork of Uniswap. It also operates on the Ethereum blockchain and uses an AMM system, but offers some additional features such as yield farming and liquidity incentives to attract users to its platform. One of the unique features of SushiSwap is its use of a native token called SUSHI, which is used for governance of the platform and for staking to earn rewards. However, SushiSwap has faced some controversy in the past due to concerns over the original developer’s exit from the project and accusations of a “rug pull” scheme.

PancakeSwap

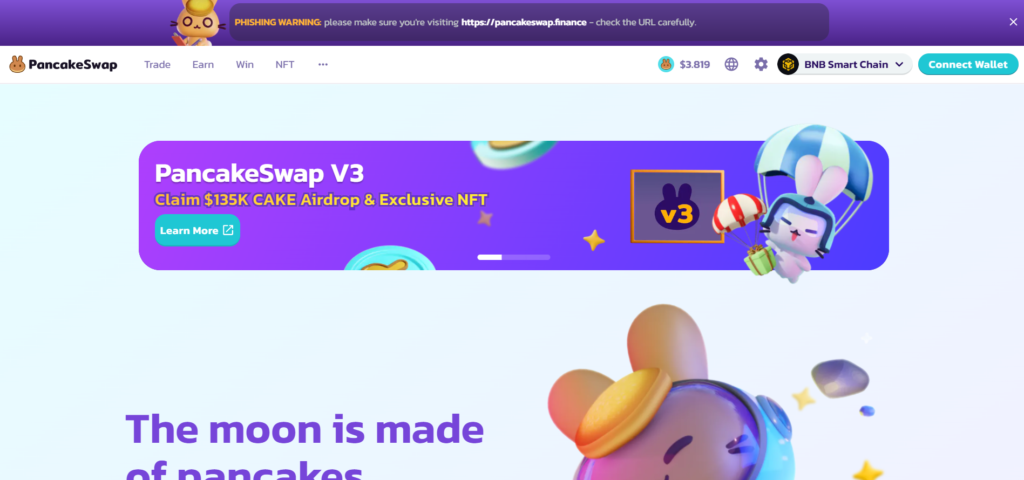

PancakeSwap is a decentralized exchange that operates on the Binance Smart Chain network, which offers faster and cheaper transactions compared to the Ethereum network. PancakeSwap uses an AMM system, similar to Uniswap and SushiSwap, and offers a range of features such as yield farming, a decentralized launchpad for new cryptocurrency projects, and a user-friendly interface. PancakeSwap also has its own native token called CAKE, which is used for governance of the platform and for staking to earn rewards.

Dexs Comparison

When comparing Uniswap, SushiSwap, and PancakeSwap, there are several factors to consider. One of the key differences between these three DEXs is the blockchain network they operate on. Uniswap and SushiSwap operate on the Ethereum network, which is known for its security and transparency, but can also suffer from congestion and high gas fees during times of high network traffic. PancakeSwap operates on the Binance Smart Chain network, which offers faster and cheaper transactions, but may be perceived as less decentralized due to its association with the centralized Binance exchange.

Another factor to consider is the range of features and incentives offered by each DEX. Uniswap offers a simple and user-friendly interface, as well as a range of liquidity pools for users to deposit their cryptocurrencies and earn fees. SushiSwap offers additional features such as yield farming and liquidity incentives, as well as its own native token for governance and rewards. PancakeSwap offers a range of features such as yield farming, a decentralized launchpad for new cryptocurrency projects, and a user-friendly interface, as well as its own native token for governance and rewards.

Finally, it is worth considering the security and transparency of each DEX. Uniswap and SushiSwap are both decentralized and transparent, and have a strong community of users who help to ensure the security of the platform. PancakeSwap, while still decentralized, may be perceived as less secure due to its association with the centralized Binance exchange. However, PancakeSwap has implemented several security measures to ensure the safety of its users, such as the use of audited smart contracts and the implementation of a bug bounty program.

Conclusion

In conclusion, Uniswap, SushiSwap, and PancakeSwap are all popular and reputable DEXs in the cryptocurrency industry. While each platform has its own advantages and drawbacks, they all offer a more decentralized, transparent, and secure way to trade cryptocurrencies compared to centralized exchanges. Traders and investors should consider factors such as the blockchain network, features and incentives, and security and transparency when choosing which DEX to use. Ultimately, the choice between Uniswap, SushiSwap, and PancakeSwap will depend on the individual needs and preferences of each user.

Disclaimer

The information provided in this article is for educational and informational purposes only. It does not constitute financial or investment advice, and you should not rely on any information provided herein for investment, financial, or any other purposes. Always do your own research and consult with a qualified financial advisor before making any investment decisions. The use of any cryptocurrency exchange, including Uniswap, SushiSwap, or PancakeSwap, is at your own risk, and you should take appropriate precautions to ensure the security of your funds. The author and publisher of this article do not make any representations or warranties with respect to the accuracy, completeness, or timeliness of any information provided herein, and they shall not be liable for any errors, omissions, or inaccuracies in such information or for any actions taken in reliance thereon.